How to Make Profit on Investments and Trading

How to Make Profit on Investments and Trading

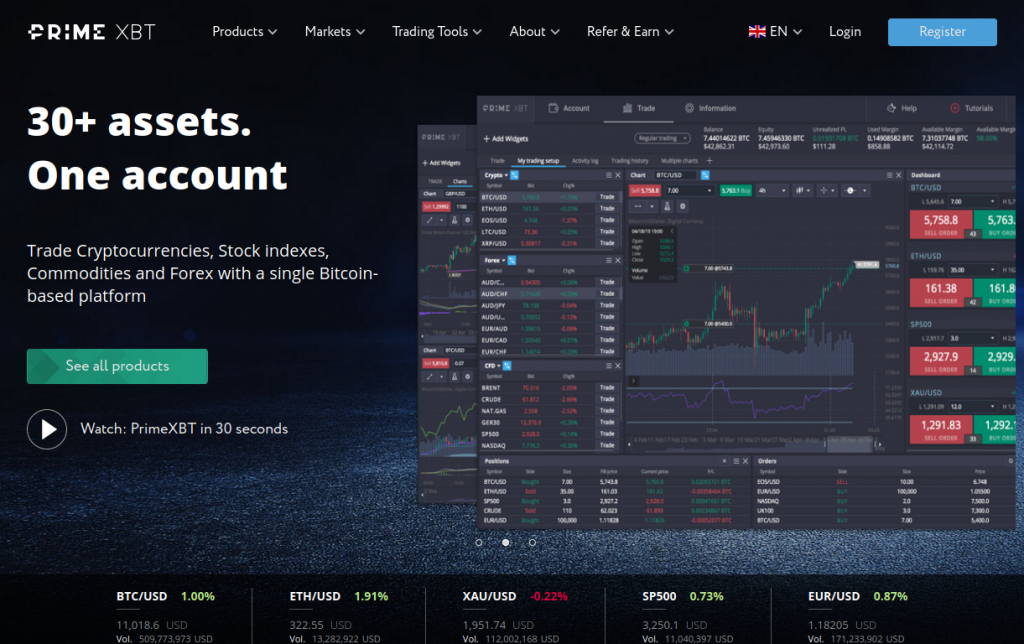

In today’s fast-paced financial landscape, making a profit from investments and trading is more crucial than ever. Whether you are a seasoned investor or a newcomer looking to understand the dynamic world of finance, there is much to explore. In this article, we will delve into some of the most effective strategies to maximize your profit potential. This includes a comprehensive look at various financial instruments, market analysis, risk management techniques, and more. For those interested in a structured approach to trading or investing, explore how to make profit on primexbt https://primexbtforex.com/account-types/ that outlines different account types suitable for your needs.

Understanding Market Fundamentals

Before diving into strategies to make a profit, it’s essential to understand the fundamentals of the market. Financial markets operate on supply and demand, and various factors influence price movements. Economic indicators, geopolitical events, and market sentiment can all create volatility and opportunities to profit. Keeping abreast of these factors will help you formulate your trading strategy and make informed decisions.

Diversification of Investment Portfolio

Diversification is a critical strategy for reducing risk while maximizing potential returns. By spreading investments across various asset classes—such as stocks, bonds, real estate, and commodities—you can mitigate the impact of a poor-performing investment on your overall portfolio. Consider employing asset allocation strategies that suit your risk tolerance and investment goals.

Technical Analysis and Charting

Many traders utilize technical analysis to forecast future price movements based on historical data. This approach involves studying charts, recognizing patterns, and utilizing various indicators (like moving averages, RSI, and MACD) to make informed trading decisions. Learning to interpret these charts enables you to identify entry and exit points effectively.

Fundamental Analysis

On the other side of the spectrum is fundamental analysis, which focuses on evaluating a company’s financial health and overall economic conditions. By analyzing financial statements, revenue growth, and future earnings potential, investors can make informed decisions about the assets they choose to invest in. Understanding metrics like P/E ratios, earnings reports, and economic indicators will help you gauge the long-term viability of your investments.

Risk Management Strategies

Effective risk management is crucial in any trading or investment strategy. This involves setting stop-loss orders, understanding position sizing, and determining how much capital you are willing to risk on each trade. A well-defined risk management plan can protect your investment and ensure longevity in the market, preventing emotional decision-making that can lead to significant losses.

Utilizing Leverage Wisely

Leverage allows traders to increase their purchasing power by borrowing funds to invest more than they currently own. While this can amplify profits, it also increases the risk of loss proportionally. It is vital to understand how to use leverage judiciously, ensuring that you do not overextend yourself, which could lead to drastic consequences during market downturns.

Continuous Learning and Adaptation

The financial landscape is continually evolving, and successful investors and traders recognize the importance of continuous education. Attend webinars, read financial literature, or consider joining trading groups to continuously refine your knowledge and strategies. Staying informed about new trading tools and market trends will keep your approach relevant and effective.

Using Technology for Trading

In the era of digital finance, leveraging technology can significantly enhance your trading efficiency. Automated trading systems and algorithms can help you execute trades at optimal times, reducing emotional stress and ensuring a disciplined approach. Additionally, using advanced trading platforms with analytical tools can provide insights that may influence your trading strategies.

Networking and Community Engagement

Engaging with other investors and traders can provide valuable insights and support. Building a network can help expose you to different perspectives and strategies that you may not have considered. Online forums, social media groups, and local investment clubs can serve as great platforms for collaboration and exchange of ideas.

Review and Adjust Your Strategies Regularly

No trading or investment strategy is flawless. Regularly reviewing your approaches and outcomes allows you to adjust and refine your strategies based on past performance. Keeping a trading journal can be beneficial, as it allows you to reflect on your successes and mistakes, learning from them for future trades.

Conclusion

Making a profit in investments and trading requires a combination of knowledge, discipline, and strategic planning. By understanding market fundamentals, diversifying your portfolio, applying risk management techniques, and continuously educating yourself, you can enhance your potential for financial success. Remember, the journey of investing is a marathon, not a sprint, so pace yourself and stay committed to your financial goals.

0 comments